Gazprom will reassess the timeline for the Kovykta field development at the end of the current year. This is stated in the company’s Board of Director’s work plan for the second half of the year.

A source familiar with the agenda for the Board of Directors meeting said that the status of the projects on Kovykta /Irkutskaya Oblast/ and Chayanda /Yakutiya/ would be reviewed at the Board of Directors meeting in December.

After acquisition of RUSIA Petroleum, the holder of Kovykta gas-condensate field development license, Gazprom virtually froze the project activities.

After acquisition of RUSIA Petroleum, the holder of Kovykta gas-condensate field development license, Gazprom virtually froze the project activities.

The issue of gas distribution from the Kovykta field located in Irkutskaya Oblast has always been a stumbling block. As a matter of fact, there is no domestic market for Kovykta gas as the gas pipeline infrastructure in Eastern Russia is not developed yet. The main option for Kovykta gas sales was export.

The December decision to restart the Kovykta field project speaks to Gazprom’s intention to finalize gas price negotiations between Russia and China, the major market for Russian gas in the Asia-Pacific region.

Gazprom previously stated that production at Kovykta would not commence until the Chayanda field goes on-line. The gas monopoly referred to the fact that Kovykta’s gas reserves have multiple components to address, especially the issue of utilizing its most valuable components, primarily helium.

Nevertheless, a number of experts expressed their concerns in regard to the success of Chayanda field gas reserves development from a technological point of view. For example, Alexander Gritsenko, Adviser to the Director General, ‘Gazprom promgas’ Research Institute, stated that geological characteristics of Chayanda gas condensate field required development of new production technologies. “Chayanda’s field formation temperature is +10°C, there are practically no fields that feature the same formation temperature in the world, and the formation pressure is abnormally low – 113-118 atmospheres instead of the required 180. How can one develop such a field?” – the expert who has been the head of Russian Research Institute for Natural Gas and Gas Technologies (VNIIGAZ) for over 20 years, is wondering. According to him Gazprom has been dealing with the challenge of finding a new technique, which would enable commercial production of gas on the Yakutiya field.

The final investment decision establishing Chayanda field development over other projects in eastern Russia, was made by Gazprom at the end of 2012. This put off prospects of developing the adjacent property in Leno-Tungusky petroleum province – Kovykta field. It would be geologically reasonable to put an emphasis on Kovykta development, – A. Gritsenko believes, in his opinion “production on Kovykta could have gone online as early as yesterday”.

Geological factors may affect the timing of putting Kovykta field into production, which is not determined yet as there is no investment decision on this field development. Still the main remaining issue is the sales market, i.e. export to China. If Gazprom and China reach consensus over the price before the end of the year, Kovykta development may accelerate. According to Sergey Pravosudov, Director of the Institute of National Energy, after signing the contract with China the decision on Kovykta field development can be made immediately.

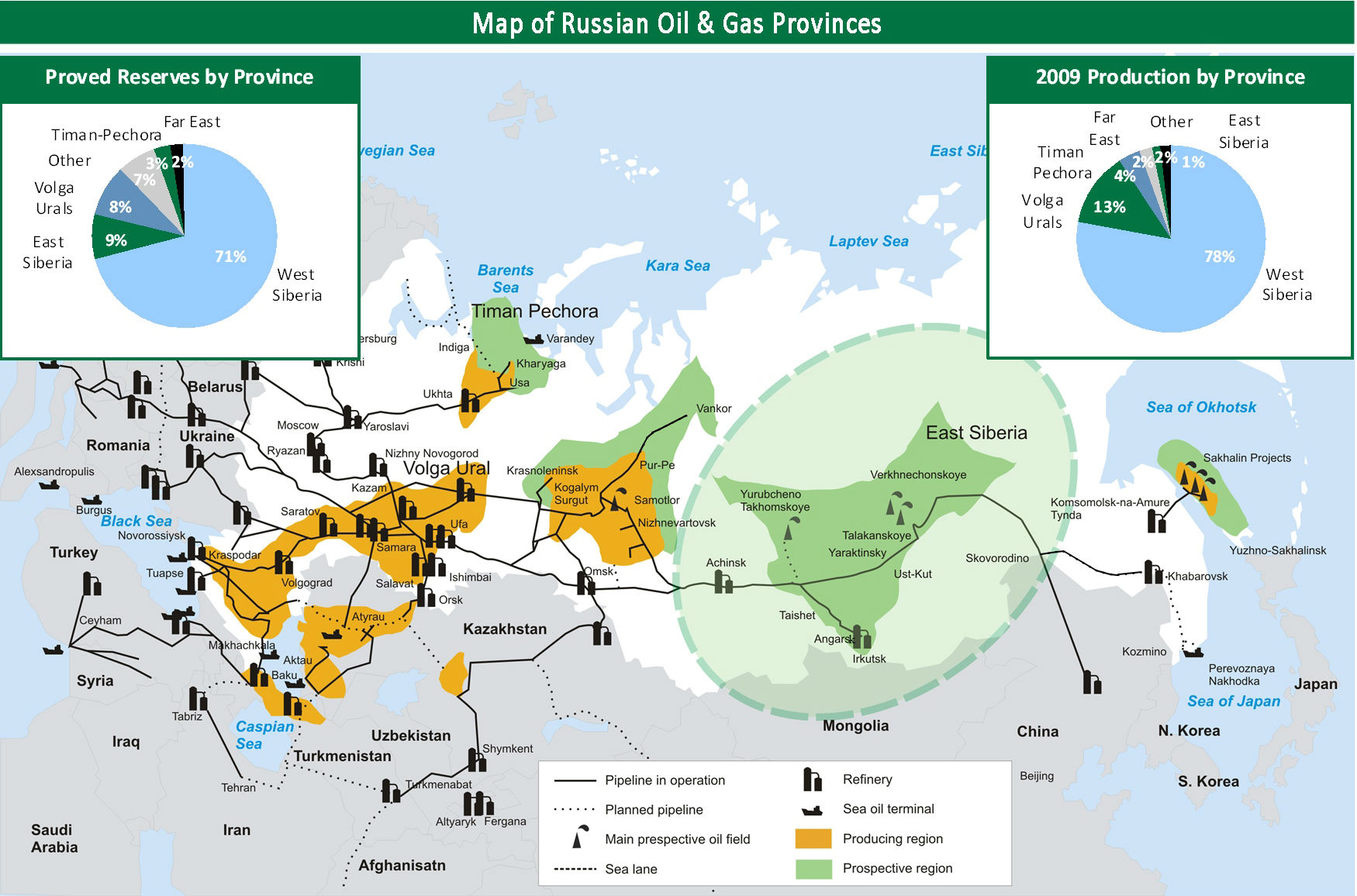

A year ago the head of Gazprom, Alexey Miller stated that the company was preparing an integrated project for Kovykta gas, condensate field and Chayanda oil, gas, condensate field development. “The integrated project for the development of the fields in Irkutskaya oblast and Yakutiya assumes the construction of a gas pipeline to connect both fields and subsequent transportation of gas from Kovykta on the new ‘Yakutiya-Khabarovsk-Vladivostok’ gas pipeline” /Siberian power/, – he said.

According to Miller two routes for the gas pipeline from Kovykta to Chayanda are considered – “North” and “South”, however the gas from the field in Irkutskaya oblast will go east.

Gazprom planned to conduct the feasibility study on the integrated project investments as early as last summer.

Gas reserves of the Chayanda field are estimated at 1.24 trillion cubic meters (44 trillion cubic feet), the oil reserves and gas condensate-in-place reserves – 79.1 MM tonnes. The Kovykta field reserves are 1.5 trillion cubic meters for gas and 77 MM tonnes for gas condensate.

Original source in Russian at http://www.biztass.ru/news/id/76442